Mobula was the obvious choice for us when we needed an API provider for all things.

CEO

UniversalX & Particle Network

Pengyu Wang

Mobula was the obvious choice for us when we needed an API provider for all things.

mobula

© 2025 Mobula. All rights reserved.

Back to top

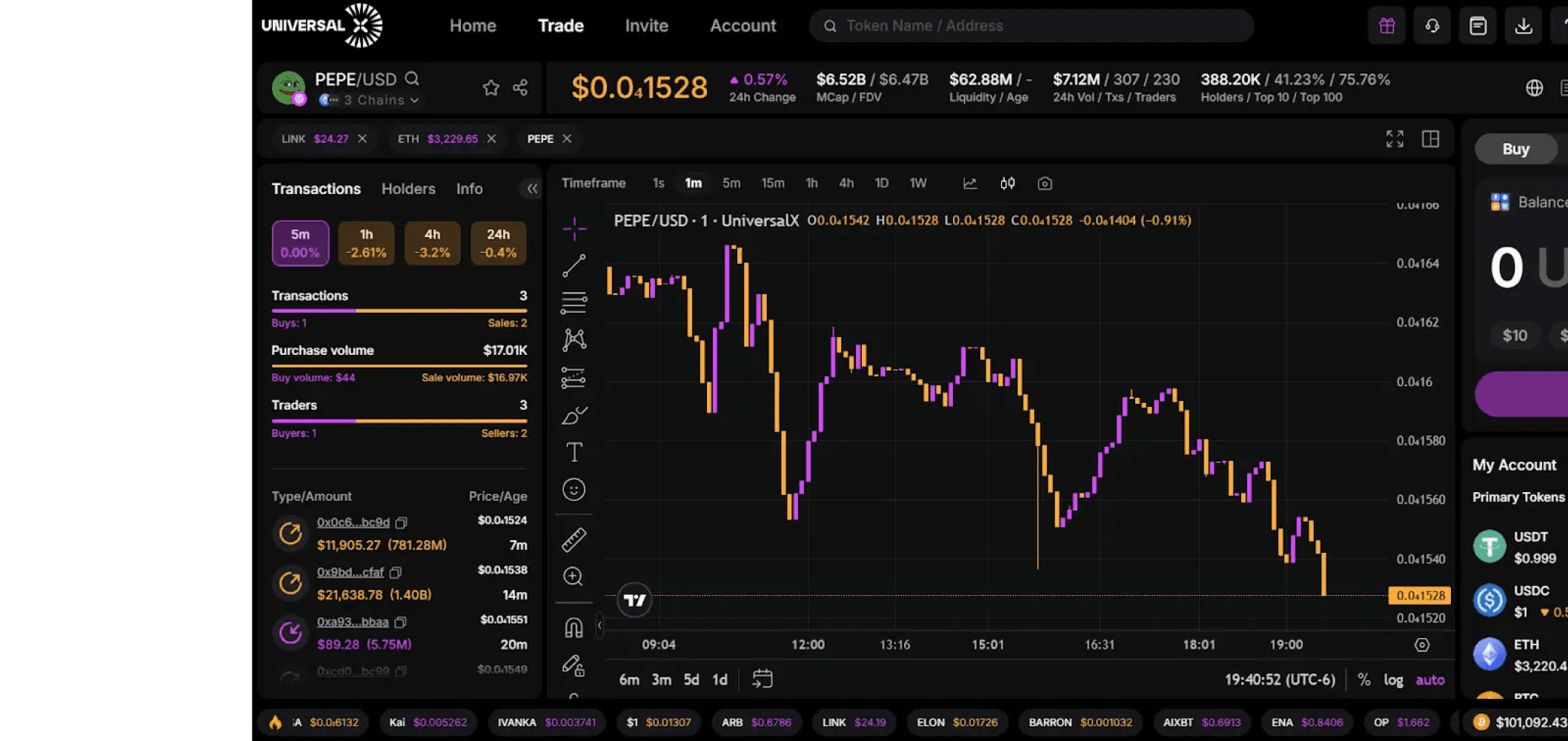

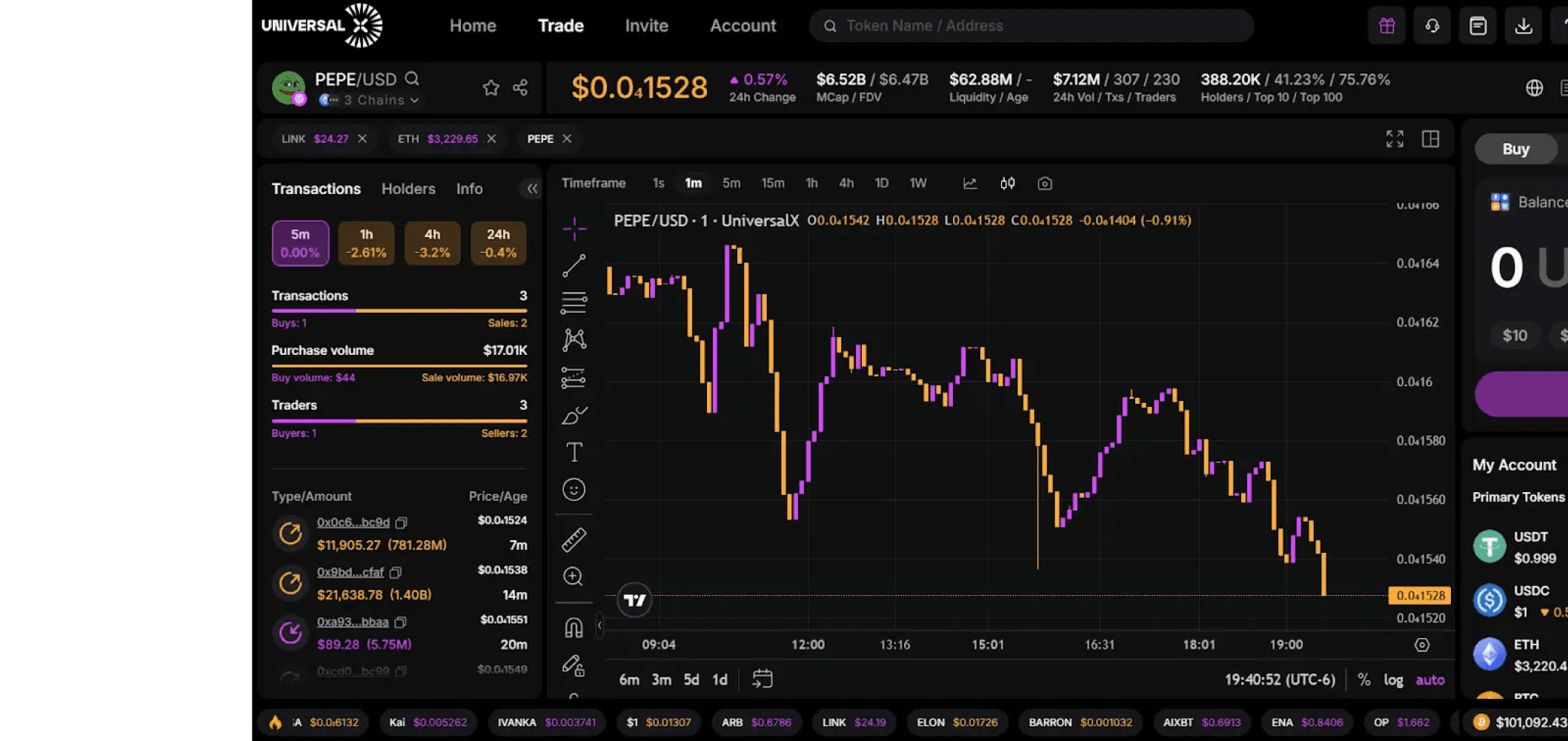

How UniversalX uses Mobula to power one of the most competitive trading frontends

As cross-chain DeFi continues to evolve, trading frontends are racing to deliver the fastest data, broadest chain coverage, and most comprehensive analytics. With median on-chain bid-ask spreads tightening across DEXs, aggregators need infrastructure partners that can keep pace with their ambition.

To compete at the highest level, teams like UniversalX

a leading cross-chain trading app, require sophisticated data infrastructure that delivers real-time market data, comprehensive security analytics, and execution capabilities—all in one unified API.

Since migrating from another provider to Mobula,

UniversalX has built one of the most competitive trading frontends in the market

offering traders faster data, deeper insights, and a seamless cross-chain experience.

What is UniversalX and how does it work?

UniversalX is a cross-chain DEX aggregator built for traders who demand the best prices across multiple blockchains. The platform aggregates liquidity from dozens of DEXs across chains including Solana, BNB, Base, and emerging networks like Monad.

UniversalX synthesizes real-time on-chain state from multiple liquidity venues to construct a live price graph, enabling them to:

Route trades

across the optimal path for best execution

Display real-time analytics

including fees paid, security scores, and holder distribution

Track wallet activity

and smart money movements

Provide instant token discovery

for new launches and trending assets

By integrating with UniversalX, traders get access to tight spreads, deep on-chain liquidity, and comprehensive security data that helps them make informed decisions in milliseconds.

Why UniversalX migrated from another provider to Mobula

Before switching to Mobula, UniversalX relied on another provider for their market data infrastructure. While they provided basic functionality, UniversalX needed a partner that could scale with their aggressive growth strategy and provide capabilities that others simply didn't offer.

The decision to migrate came down to five critical factors:

1. 24/7 Support & Hands-On Partnership

UniversalX needed a data provider that operated as a true partner, not just a vendor. Mobula's team provided:

Dedicated support

with rapid response times

Custom chain deployments aligned with UniversalX's launch strategy—Mobula shipped support for new chains specifically to match UniversalX's roadmap

Direct engineering collaboration

for integration optimization

"Mobula didn't just give us an API key and walk away. They shipped new chain support specifically to align with our launch strategy. That kind of partnership is rare."

Peter, CTO UniversalX

2. New Datapoints Added On Demand

As UniversalX evolved their product, they needed data that others couldn't provide:

Bonding curve analytics

for pump-style tokens

Holder distribution metrics

(top 10 holders, dev holdings, sniper detection)

Pro trader and smart money tracking

Organic volume filtering

(bot-filtered metrics)

Mobula's team added these datapoints on demand, enabling UniversalX to build features their competitors couldn't match.

3. Fees Paid & Security APIs

A critical differentiator for UniversalX was comprehensive security data:

Feature

Mobula

Others

DEX Screener ad status

Fees paid tracking

Insider holdings %

Sniper detection

Bundler analytics

Pro trader counts

These security metrics allow UniversalX users to quickly assess token risk before trading—a feature that has become essential for traders navigating the memecoin landscape.

4. Faster & More Competitive with Axiom and Others

Speed is everything in trading. Mobula's indexation latency consistently outperforms others across all major chains:

Chain

Mobula

Codex

Improvement

BNB

272ms

1.70s

6.3x faster

Solana

634ms

1.79s

2.8x faster

Monad

507ms

2.06s

4.1x faster

Base

1.79s

1.83s

~1x

*Source:

— Open-source benchmark tool available at

*

This latency advantage means UniversalX users see trades faster, get fresher quotes, and can react to market movements before competitors' users.

5. Execution Stack for Building Txs All-in-One

Beyond data, Mobula provides a complete execution stack that Codex lacks:

Transaction building

for swaps across multiple DEX protocols

Quote aggregation

from all major liquidity venues

Gas estimation

and optimization

Cross-chain routing

with unified APIs

This all-in-one approach eliminated the need for UniversalX to integrate multiple third-party services, reducing complexity and latency.

How Mobula powers UniversalX's competitive edge

Real-Time WebSocket Streaming

At the core of UniversalX's trading interface is Mobula's Pulse V2 stream, which delivers:

Sub-second updates

for price changes, volume, and market cap

Real-time token discovery

for new launches

Live holder analytics

as positions change

Bonding curve progress

for pump-style tokens

Comprehensive Token Analytics

Every token on UniversalX displays rich analytics powered by Mobula:

Market metrics

: Price, market cap, liquidity, volume

Security scores

: Top 10 holder concentration, dev holdings, insider percentage

Trader analytics

: Pro trader count, smart money activity, fresh wallet buys

Social data

: Twitter, website, DEX Screener listing status

Multi-Chain Coverage

Mobula's unified API means UniversalX can offer the same rich experience across:

Solana

BNB Chain

Base

Monad

And new chains as they launch

The Results

Since migrating to Mobula, UniversalX has achieved:

One of the Most Competitive Frontends in the Market

UniversalX now competes directly with Axiom, Photon, and other leading trading terminals—offering comparable or better:

Data freshness

Token discovery speed

Security analytics depth

Reduced Engineering Overhead

Eliminated multi-vendor integration complexity

Single API for data + execution

Faster feature development cycles

Improved User Experience

Faster trade confirmations

Richer token analytics

Better risk assessment tools for traders

New Chain Launches Aligned with Strategy

Custom chain support shipped on UniversalX's timeline

First-mover advantage on emerging chains

Coordinated launch strategies with Mobula team

"With Mobula, we don't just get data—we get a partner that moves as fast as we do. The combination of speed, security APIs, and hands-on support has been transformative for our product."

—

UniversalX Team

Essential Trading Infrastructure for DeFi Aggregators

Mobula isn't simply an optimization—it is foundational infrastructure that every latency-sensitive DeFi application needs to compete at the highest level.

With on-chain transaction volumes accelerating across Solana, BNB, and emerging L2s, trading frontends need a data infrastructure partner capable of:

Delivering sub-second latency

across all major chains

Providing security-first analytics

for trader protection

Scaling globally

without reliability concerns

Adding new datapoints

as products evolve

Supporting new chains

aligned with launch strategies

Mobula is the fastest, most comprehensive way to power a trading frontend. No more juggling multiple APIs. No more missing datapoints. No more waiting for chain support.

The race is on. Are you ready to build?

Get Started with Mobula

Experience the fastest crypto data API yourself:

Resource

Link

Get Free API Key

View API Docs

WebSocket Streams

Latency Benchmarks

Open Source Benchmark

Want to build the next competitive trading frontend?

How UniversalX uses Mobula to power one of the most competitive trading frontends

As cross-chain DeFi continues to evolve, trading frontends are racing to deliver the fastest data, broadest chain coverage, and most comprehensive analytics. With median on-chain bid-ask spreads tightening across DEXs, aggregators need infrastructure partners that can keep pace with their ambition.

To compete at the highest level, teams like

UniversalX

, a leading cross-chain trading app, require sophisticated data infrastructure that delivers real-time market data, comprehensive security analytics, and execution capabilities—all in one unified API.

Since migrating from another provider to Mobula,

UniversalX has built one of the most competitive trading frontends in the market

, offering traders faster data, deeper insights, and a seamless cross-chain experience.

What is UniversalX and how does it work?

UniversalX is a cross-chain DEX aggregator built for traders who demand the best prices across multiple blockchains. The platform aggregates liquidity from dozens of DEXs across chains including Solana, BNB, Base, and emerging networks like Monad.

UniversalX synthesizes real-time on-chain state from multiple liquidity venues to construct a live price graph, enabling them to:

Route trades

across the optimal path for best execution

Display real-time analytics

including fees paid, security scores, and holder distribution

Track wallet activity

and smart money movements

Provide instant token discovery

for new launches and trending assets

By integrating with UniversalX, traders get access to tight spreads, deep on-chain liquidity, and comprehensive security data that helps them make informed decisions in milliseconds.

Why UniversalX migrated from another provider to Mobula

Before switching to Mobula, UniversalX relied on another provider for their market data infrastructure. While they provided basic functionality, UniversalX needed a partner that could scale with their aggressive growth strategy and provide capabilities that others simply didn't offer.

The decision to migrate came down to five critical factors:

1. 24/7 Support & Hands-On Partnership

UniversalX needed a data provider that operated as a true partner, not just a vendor. Mobula's team provided:

Dedicated support

with rapid response times

Custom chain deployments aligned with UniversalX's launch strategy—Mobula shipped support for new chains specifically to match UniversalX's roadmap

Direct engineering collaboration

for integration optimization

"Mobula didn't just give us an API key and walk away. They shipped new chain support specifically to align with our launch strategy. That kind of partnership is rare."

— Peter, CTO UniversalX

2. New Datapoints Added On Demand

As UniversalX evolved their product, they needed data that others couldn't provide:

Bonding curve analytics

for pump-style tokens

Holder distribution metrics

(top 10 holders, dev holdings, sniper detection)

Pro trader and smart money tracking

Organic volume filtering

(bot-filtered metrics)

Mobula's team added these datapoints on demand, enabling UniversalX to build features their competitors couldn't match.

3. Fees Paid & Security APIs

A critical differentiator for UniversalX was comprehensive security data:

Feature

Mobula

Others

DEX Screener ad status

Fees paid tracking

Insider holdings %

Sniper detection

Bundler analytics

Pro trader counts

These security metrics allow UniversalX users to quickly assess token risk before trading—a feature that has become essential for traders navigating the memecoin landscape.

4. Faster & More Competitive with Axiom and Others

Speed is everything in trading. Mobula's indexation latency consistently outperforms others across all major chains:

Chain

Mobula

Codex

Improvement

BNB

272ms

1.70s

6.3x faster

Solana

634ms

1.79s

2.8x faster

Monad

507ms

2.06s

4.1x faster

Base

1.79s

1.83s

~1x

*Source:

— Open-source benchmark tool available at

*

This latency advantage means UniversalX users see trades faster, get fresher quotes, and can react to market movements before competitors' users.

5. Execution Stack for Building Txs All-in-One

Beyond data, Mobula provides a complete execution stack that Codex lacks:

Transaction building

for swaps across multiple DEX protocols

Quote aggregation

from all major liquidity venues

Gas estimation

and optimization

Cross-chain routing

with unified APIs

This all-in-one approach eliminated the need for UniversalX to integrate multiple third-party services, reducing complexity and latency.

How Mobula powers UniversalX's competitive edge

Real-Time WebSocket Streaming

At the core of UniversalX's trading interface is Mobula's Pulse V2 stream, which delivers:

Sub-second updates

for price changes, volume, and market cap

Real-time token discovery

for new launches

Live holder analytics

as positions change

Bonding curve progress

for pump-style tokens

Comprehensive Token Analytics

Every token on UniversalX displays rich analytics powered by Mobula:

Market metrics

: Price, market cap, liquidity, volume

Security scores

: Top 10 holder concentration, dev holdings, insider percentage

Trader analytics

: Pro trader count, smart money activity, fresh wallet buys

Social data

: Twitter, website, DEX Screener listing status

Multi-Chain Coverage

Mobula's unified API means UniversalX can offer the same rich experience across:

Solana

BNB Chain

Base

Monad

And new chains as they launch

The Results

Since migrating to Mobula, UniversalX has achieved:

One of the Most Competitive Frontends in the Market

UniversalX now competes directly with Axiom, Photon, and other leading trading terminals—offering comparable or better:

Data freshness

Token discovery speed

Security analytics depth

Reduced Engineering Overhead

Eliminated multi-vendor integration complexity

Single API for data + execution

Faster feature development cycles

Improved User Experience

Faster trade confirmations

Richer token analytics

Better risk assessment tools for traders

New Chain Launches Aligned with Strategy

Custom chain support shipped on UniversalX's timeline

First-mover advantage on emerging chains

Coordinated launch strategies with Mobula team

"With Mobula, we don't just get data—we get a partner that moves as fast as we do. The combination of speed, security APIs, and hands-on support has been transformative for our product."

—

UniversalX Team

Essential Trading Infrastructure for DeFi Aggregators

Mobula isn't simply an optimization—it is foundational infrastructure that every latency-sensitive DeFi application needs to compete at the highest level.

With on-chain transaction volumes accelerating across Solana, BNB, and emerging L2s, trading frontends need a data infrastructure partner capable of:

Delivering sub-second latency

across all major chains

Providing security-first analytics

for trader protection

Scaling globally

without reliability concerns

Adding new datapoints

as products evolve

Supporting new chains

aligned with launch strategies

Mobula is the fastest, most comprehensive way to power a trading frontend. No more juggling multiple APIs. No more missing datapoints. No more waiting for chain support.

The race is on. Are you ready to build?

Get Started with Mobula

Experience the fastest crypto data API yourself:

Resource

Link

Get Free API Key

View API Docs

WebSocket Streams

Latency Benchmarks

Open Source Benchmark

Want to build the next competitive trading frontend?

How UniversalX uses Mobula to power one of the most competitive trading frontends

As cross-chain DeFi continues to evolve, trading frontends are racing to deliver the fastest data, broadest chain coverage, and most comprehensive analytics. With median on-chain bid-ask spreads tightening across DEXs, aggregators need infrastructure partners that can keep pace with their ambition.

To compete at the highest level, teams like

UniversalX , a leading cross-chain trading app, require sophisticated data infrastructure that delivers real-time market data, comprehensive security analytics, and execution capabilities—all in one unified API.

Since migrating from another provider to Mobula, UniversalX has built one of the most competitive trading frontends in the market , offering traders faster data, deeper insights, and a seamless cross-chain experience.

What is UniversalX and how does it work?

UniversalX is a cross-chain DEX aggregator built for traders who demand the best prices across multiple blockchains. The platform aggregates liquidity from dozens of DEXs across chains including Solana, BNB, Base, and emerging networks like Monad.

UniversalX synthesizes real-time on-chain state from multiple liquidity venues to construct a live price graph, enabling them to:

Route trades: across the optimal path for best execution

Display real-time analytics: including fees paid, security scores, and holder distribution

Track wallet activity: and smart money movements

Provide instant token discovery: for new launches and trending assets

By integrating with UniversalX, traders get access to tight spreads, deep on-chain liquidity, and comprehensive security data that helps them make informed decisions in milliseconds.

Why UniversalX migrated from another provider to Mobula

Before switching to Mobula, UniversalX relied on another provider for their market data infrastructure. While they provided basic functionality, UniversalX needed a partner that could scale with their aggressive growth strategy and provide capabilities that others simply didn't offer.

The decision to migrate came down to five critical factors:

1. 24/7 Support & Hands-On Partnership

UniversalX needed a data provider that operated as a true partner, not just a vendor. Mobula's team provided:

Dedicated support with rapid response times

Custom chain deployments

aligned with UniversalX's launch strategy—Mobula shipped support for new chains specifically to match UniversalX's roadmap

Direct engineering collaboration

for integration optimization

"Mobula didn't just give us an API key and walk away. They shipped new chain support specifically to align with our launch strategy. That kind of partnership is rare."

— Peter, CTO UniversalX

2. New Datapoints Added On Demand

As UniversalX evolved their product, they needed data that others couldn't provide:

Bonding curve analytics:

for pump-style tokens

Holder distribution metrics: (top 10 holders, dev holdings, sniper detection)

Pro trader and smart money tracking

Organic volume filtering

(bot-filtered metrics)

Mobula's team added these datapoints on demand, enabling UniversalX to build features their competitors couldn't match.

3. Fees Paid & Security APIs

A critical differentiator for UniversalX was comprehensive security data:

Feature

Mobula

Others

DEX Screener ad status

Fees paid tracking

Insider holdings %

Sniper detection

Bundler analytics

Pro trader counts

These security metrics allow UniversalX users to quickly assess token risk before trading—a feature that has become essential for traders navigating the memecoin landscape.

4. Faster & More Competitive with Axiom and Others

Speed is everything in trading. Mobula's indexation latency consistently outperforms others across all major chains:

Chain

Mobula

Codex

Improvement

BNB

272ms

1.70s

6.3x faster

Solana

634ms

1.79s

2.8x faster

Monad

507ms

2.06s

4.1x faster

Base

1.79s

1.83s

~1x

*Source:

— Open-source benchmark tool available at

*

This latency advantage means UniversalX users see trades faster, get fresher quotes, and can react to market movements before competitors' users.

5. Execution Stack for Building Txs All-in-One

Beyond data, Mobula provides a complete execution stack that Codex lacks:

Transaction building: for swaps across multiple DEX protocols

Quote aggregation: from all major liquidity venues

Gas estimation

and optimization

Cross-chain routing

with unified APIs

This all-in-one approach eliminated the need for UniversalX to integrate multiple third-party services, reducing complexity and latency.

How Mobula powers UniversalX's competitive edge

Real-Time WebSocket Streaming

At the core of UniversalX's trading interface is Mobula's Pulse V2 stream, which delivers:

Sub-second updates:

for price changes, volume, and market cap

Real-time token discovery:

for new launches

Live holder analytics:

as positions change

Bonding curve progress

for pump-style tokens

Comprehensive Token Analytics

Every token on UniversalX displays rich analytics powered by Mobula:

Market metrics: : Price, market cap, liquidity, volume

Security scores: : Top 10 holder concentration, dev holdings, insider percentage

Trader analytics: : Pro trader count, smart money activity, fresh wallet buys

Social data: : Twitter, website, DEX Screener listing status

Multi-Chain Coverage

Mobula's unified API means UniversalX can offer the same rich experience across:

Solana

BNB Chain

Base

Monad

And new chains as they launch

The Results

Since migrating to Mobula, UniversalX has achieved:

One of the Most Competitive Frontends in the Market

UniversalX now competes directly with Axiom, Photon, and other leading trading terminals—offering comparable or better:

Data freshness

Token discovery speed

Security analytics depth

Reduced Engineering Overhead

Eliminated multi-vendor integration complexity

Single API for data + execution

Faster feature development cycles

Improved User Experience

Faster trade confirmations

Richer token analytics

Better risk assessment tools for traders

New Chain Launches Aligned with Strategy

Custom chain support shipped on UniversalX's timeline

First-mover advantage on emerging chains

Coordinated launch strategies with Mobula team

"With Mobula, we don't just get data—we get a partner that moves as fast as we do. The combination of speed, security APIs, and hands-on support has been transformative for our product."

—

UniversalX Team

Essential Trading Infrastructure for DeFi Aggregators

Mobula isn't simply an optimization—it is foundational infrastructure that every latency-sensitive DeFi application needs to compete at the highest level.

With on-chain transaction volumes accelerating across Solana, BNB, and emerging L2s, trading frontends need a data infrastructure partner capable of:

Delivering sub-second latency

across all major chains

Providing security-first analytics

for trader protection

Scaling globally

without reliability concerns

Adding new datapoints

as products evolve

Supporting new chains

aligned with launch strategies

Mobula is the fastest, most comprehensive way to power a trading frontend. No more juggling multiple APIs. No more missing datapoints. No more waiting for chain support.

The race is on. Are you ready to build?

Get Started with Mobula

Experience the fastest crypto data API yourself:

Resource

Link

Get Free API Key

View API Docs

WebSocket Streams

Latency Benchmarks

Open Source Benchmark

Want to build the next competitive trading frontend?